And since some SDIRAs for example self-directed common IRAs are matter to required least distributions (RMDs), you’ll really need to system forward to make certain that you've got enough liquidity to satisfy The foundations set by the IRS.

Have the liberty to take a position in Nearly any sort of asset which has a risk profile that fits your investment technique; like assets which have the likely for a greater rate of return.

Irrespective of whether you’re a fiscal advisor, investment issuer, or other economical Skilled, investigate how SDIRAs may become a powerful asset to develop your small business and reach your Qualified goals.

SDIRAs in many cases are utilized by fingers-on traders who will be willing to take on the challenges and obligations of choosing and vetting their investments. Self directed IRA accounts can even be perfect for buyers who have specialised expertise in a niche industry they would want to spend money on.

As soon as you’ve uncovered an SDIRA provider and opened your account, you could be pondering how to really commence investing. Comprehension the two The foundations that govern SDIRAs, in addition to the way to fund your account, will help to lay the foundation for your way forward for successful investing.

Ahead of opening an SDIRA, it’s important to weigh the possible advantages and drawbacks determined by your certain economic goals and possibility tolerance.

Sure, housing is one of our consumers’ most popular investments, in some cases named a property IRA. Consumers have the option to speculate in every thing from rental Attributes, commercial housing, undeveloped land, mortgage notes plus much more.

No, You can not spend money on your own personal business enterprise having a self-directed IRA. The IRS prohibits any transactions concerning your IRA along with your own enterprise as you, given that the operator, are thought of a disqualified human being.

Ease of Use and Technology: A user-helpful System with on the net applications to trace your investments, post files, and regulate your account is very important.

Real estate property is among the most well-liked alternatives among SDIRA holders. That’s due to the fact you could spend money on any kind of property having a self-directed IRA.

Criminals often prey on SDIRA holders; encouraging them to open up accounts for the goal of building fraudulent investments. They usually fool investors by telling them that In the event the investment is accepted by a self-directed IRA custodian, it needs to be respectable, which isn’t accurate. Once more, make sure to do extensive due diligence on all investments you decide on.

Entrust can aid you in purchasing alternative investments with all your retirement cash, and administer the purchasing and selling of assets that are usually unavailable through banking institutions and brokerage firms.

Think your friend may very well be starting off the next Facebook or Uber? With the SDIRA, you may spend money on causes that you think in; and possibly take pleasure in bigger returns.

Sometimes, the expenses connected with SDIRAs can be larger and more challenging than with a daily IRA. This is due to of your increased complexity associated with administering the account.

Customer Aid: Try to look for a supplier that gives dedicated support, together with entry to well-informed specialists who can answer questions on compliance and IRS procedures.

Lots of traders are stunned to discover that utilizing retirement resources to speculate in alternative assets has become attainable considering the fact that 1974. Having said that, most brokerage firms and financial institutions center on offering publicly traded securities, like stocks and bonds, simply because they deficiency the infrastructure and expertise to handle privately held assets, for instance real estate property or private equity.

Be answerable for how you improve your retirement portfolio by utilizing your specialized information and passions to speculate in assets that in good shape with all your values. Received skills in real estate property or non-public equity? Utilize it to assistance your retirement planning.

Shifting funds from 1 variety of account to another type of account, like shifting funds from the 401(k) to a conventional IRA.

A self-directed IRA is undoubtedly an extremely highly effective investment automobile, however it’s not for everybody. As the indicating goes: with fantastic power arrives excellent obligation; and using an SDIRA, see this that couldn’t be extra accurate. Continue reading to master why an SDIRA may well, or might not, be in your case.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Sam Woods Then & Now!

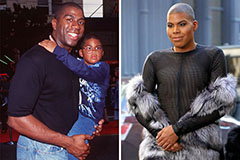

Sam Woods Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now!